About Us

Executive Editor:Publishing house "Academy of Natural History"

Editorial Board:

Asgarov S. (Azerbaijan), Alakbarov M. (Azerbaijan), Aliev Z. (Azerbaijan), Babayev N. (Uzbekistan), Chiladze G. (Georgia), Datskovsky I. (Israel), Garbuz I. (Moldova), Gleizer S. (Germany), Ershina A. (Kazakhstan), Kobzev D. (Switzerland), Kohl O. (Germany), Ktshanyan M. (Armenia), Lande D. (Ukraine), Ledvanov M. (Russia), Makats V. (Ukraine), Miletic L. (Serbia), Moskovkin V. (Ukraine), Murzagaliyeva A. (Kazakhstan), Novikov A. (Ukraine), Rahimov R. (Uzbekistan), Romanchuk A. (Ukraine), Shamshiev B. (Kyrgyzstan), Usheva M. (Bulgaria), Vasileva M. (Bulgar).

Engineering

It has been revealed that SMS informing is eligible for long and mid-term trading. For short-term trading the SMS informing may be too slow, so it's recommended to use other solutions that offer faster ways of informing traders about detected trading signals.

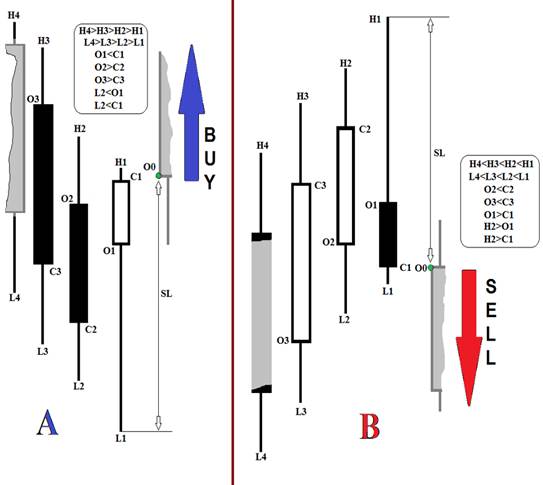

Novice traders may lack their own skill in trading operations and often take a loss. For such situations trading with incoming trading signals that are received via subscription can significantly help. Moreover, people who are not professional traders can make decisions based on those incoming signals. Trading signals are recommendations on opening (closing orders) made by successful traders, who make decisions based on analyzing of state of the market (manual mode), semi-automatic (professional trader and special software) or fully automatic (opening signals, changing states of trading orders are made by software developed with using of effective analyzing algorithms that are made by experienced traders and financial analysts and don't require human intervention). As an example of an algorithm that reveals a signal for buying or selling we can use[1]: The signals for the opening of an order to buy or sell implemented lines of code: if h4>h3 and h3>h2 and h2>h1 and l4>l3 and l3>l2 and l2>l1 and o1<c1 and o2>c2 and o3>c3 and l2<o1 and l2<c1 - to open a buy order; if h4 <h3) and h3 <h2 and h2 <h1 and l4 <l3 and l3 <l2 and l2<l1 and o2<c2 and o3<c3 and o1>c1 and h2>o1 and h2>c1 - to open a sell order. Variables: o0 - Price opening current (zero) candles, l1 - the minimum value of the first candle (Low [1]), l2, l3, l4 - 2, 3, 4-x, respectively. h1 - the maximum value of the first candle (High [1]), h2, h3, h4 - 2, 3, 4-x, respectively. The opening price of the first candle - o1 (Open [1]), o2, o3 - 2, 3-x. The closing price of the first candle - c1 (Close [1]), the second and third - c2 and c3. Presented in Fig. 1.

Figure 1 - candlestick patterns that determine the signals to buy (A) or sale (B) trading tool

The algorithm above works on various time intervals or timeframes: 1 minute (M1), 5 minutes (M5), 30 minutes (M3), or 1-hour timeframe (H1). Obviously, the less is working timeframe the faster the information about signal should be delivered to trader.

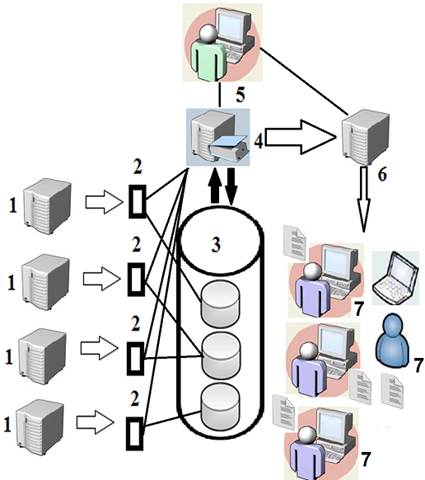

In the Figure number 2 a functional scheme of Hardware/Software System of informing traders about trading signals is shown: 1 - collectors of information about incoming quotations of financial instruments with one or several trading platforms; 2 - connectors(data converters) that are responsible for information conversion into unified data view and storage format; 3 - database (databases) for storage of collected information; 4 - Software/Analytical system for rapid analyzing data that is responsible for trading recommendations output and transferring to distribution server - 6; 5 - operator workplace, that is responsible for administrating of system functionality including users subscription - 7; confirmation or cancellation of signals formed by block 4 (when working under operator supervision) and possibility of rapid information forming about a signal in fully manual mode when operator inputs data.

Figure 2 - a functional scheme of Hardware/Software system of informing traders about trading signals

Subscribers (traders) can get signals on opening (closing, changing) of positions by:

- Skype

- SMS messaging

- push-notifications(for smartphone and other devices users )

- Other methods (that are rarely used, but have a right to exist. For example, a phone call by a robot or a human warning that it's a good time for buying or selling financial instrument).

Operations with orders can also be in fully automatic mode if there is a specific Software installed on subscribers workplace that executes operations with orders based on incoming signal for trading financial instrument.

SMS messaging is an effective method of notification. Information is delivered fast enough if a mobile phone (or a smartphone, communicator) is turned on and located in the coverage zone of mobile operator. Messages are sent from mobile phone using a special application or via a personal computer with installed cellular modem also using special Software. The advantage of this method is that Hardware/Software System (mobile phone, cellular modem) used for SMS distribution (from now on the "SMS-server") is located in vendors area and fully controlled by vendor.

SMS-server allows SMS sending through mobile operator that excludes delays related to transferring information in computer networks (before server (alternative variant) SMS distribution via Internet), possibility of deliberate modification and/or destruction of information intended for SMS messages sent through network channels of Internet. Using of SMS-server provides variety of advantages including auto startup of SMS-server when Operating System starts, automatic initialization of GSM device with possibility of configuring that device according to its type and work profile used. There is no problem with sending long (multiple) SMS written in russian text or other language that is not based on Latin due to fast enabling or disabling Unicode, SMS-server can be configured for working with multiple GSM devices (for provision fault tolerance and, when needed to send a lot of messages making fast informing possible without delays that especially critical for traders because market situation can change rapidly and distributed information becomes obsolete rapidly as well). It should be noted that personal SMS-server also has some disadvantages that are relative high cost due to necessity of buying special Hardware, Software for SMS distribution (or develop by your own), making maintenance, possibly higher cost of sending SMS than using specialized server in the Internet etc.

As an alternative SMS gateway distribution for informing traders located in the Internet can be used. The advantage is that SMS might be sent without using of mobile phone, there is no necessity of buying Hardware for making own SMS-server. Impossibility of managing the Hardware of SMS distribution, possible problems related with delays when the channel is overloaded and chance of interception changing or destruction of information are the disadvantages of distribution through Internet network.

Implementation of distribution through the SMS gateway is provided with API that includes creating and managing distribution. For example http://sms-sending.ru/. Technical information about integration with SMS applications is located on (XML-protocol) http://sms-sending.ru/integracia/xml.html. The rates are 0.6-2.1 RUB per 1 SMS (Depends on mobile operator and number of SMS in distribution).

It should be noted that trader informing about trading signals via SMS distribution might be an alternative to push-notifications about signals or duplicate unit that allows delivering information more safely. Push-notifications appears on the display of the mobile phone (device should be connected to Internet network). The cost of push-notifications is significantly lower that SMS and all modern mobile Operating Systems do support push-notifications.

In addition, SMS could be sent using Skype. This function is chargeable. Distribution in automatic mode is possible based on using one of two technical approaches both based on calling the dynamic libraries (DLL). The first variant refer to making special scenario file (macrofile) that allows intercepting keyboard and mouse input. After Skype in opened, the SMS sending is selected, the number of SMS receiver is pasted into the field, also the message is pasted from buffer into another field(the message was inserted by working trader informing system), and sending to the addressee after all. The second variant is based on the fact Skype supports API and ActiveX interfaces.

In conclusion it's important to notice that SMS informing suits best for signals of long and mid-term trading, but for short-term the method of SMS informing may be not fast enough(or in some cases very slow). If a trader is using scalping strategies SMS informing is unacceptable because when SMS is sent by distribution system and received by trader the signal will become obsolete and trading with obsolete signals leads to losses. SMS informing about trading signals suits best for strategies described by author in works [2-7].

2. Anantchenko I.V., Shcherbovich-Vecher A.V., Savkin A.A., Design and development of systems for informing traders about trading signals. In collection of: Science, education and innovation. Collection of articles of International scientific-practical conference. – 2015. – P. 3-5.

3. Anantchenko I.V. Construction of boundary lines of the market for trading EUR/USD based on the analysis of option levels for currency futures according to the daily reports of the Chicago stock exchange (CME GROUP). In the collection: Innovation, technology, science. Collection of articles of International scientific-practical conference. – 2016. – P. 5-7.

4. Anantchenko I.V., Kamashev A. O., Bazarov I. B. Algorithm of open orders for the currency pair EUR/USD on the Forex market based on the optional levels of the first order. In the book: Patterns and trends of innovative development of society. Collection of articles of International scientific-practical conference. – 2016. – P. 62-64.

5. Ananchenko I.V. Strategy of trading in the Forex market EUR/USD based on the analysis of option levels for currency futures according to the daily reports of the Chicago stock exchange (CME GROUP). In the book: Innovative research: theory, methodology, practice. Collection of articles of International scientific-practical conference. 2016. – P. 95-99.

6. Simulation of a chaotic process, based on the criterion of utility. Ananchenko I.V., Musaev A. A. In: Seventh All-Russia scientific-practical conference "Simulation Theory and Practice." (IMMOD 2015). – 2015. – P. 142-147.

7. Management Strategy for Mechanical Trade Systems: Brief Review. Musaev A., Anantchenko I., Gazul S., Int J Econ Manag Sci 2015, 4:9. http://dx.doi.org/10.4172/2162-6359.100028

Anantchenko I.V. USING OF SHORT MESSAGE SERVICE (SMS) FOR INFORMING TRAIDERS ABOUT TRAIDING SIGNALS. International Journal Of Applied And Fundamental Research. – 2016. – № 6 –

URL: www.science-sd.com/468-25203 (28.02.2026).

PDF

PDF